Introduction to the PCB Industry in China

The Printed Circuit Board (PCB) industry is a crucial component of the electronics manufacturing sector, providing the foundation for a wide range of electronic devices and applications. China has emerged as a global leader in PCB production, with a significant market share and a robust manufacturing ecosystem. This article explores the current state of the China PCB industry, analyzes key trends and drivers, and provides forecasts for its future growth and development.

Market Overview and Key Players

Market Size and Growth

The China PCB industry has experienced substantial growth in recent years, driven by the increasing demand for electronic devices and the rapid development of emerging technologies. According to market research, the China PCB industry was valued at approximately USD 32.7 billion in 2020 and is expected to reach USD 48.6 billion by 2025, with a compound annual growth rate (CAGR) of 8.2% during the forecast period.

Major Players and Market Share

The China PCB industry is highly fragmented, with numerous players competing in various market segments. Some of the key players in the industry include:

- Zhen Ding Technology Holding Limited (ZDT)

- Shennan Circuits Co., Ltd.

- Wus Printed Circuit Co., Ltd.

- Shenzhen Kinwong Electronic Co., Ltd.

- Shennan Circuits Co., Ltd.

These top players collectively account for a significant market share, with ZDT leading the industry in terms of revenue and production capacity.

Market Segmentation and Applications

PCB Types and Applications

The China PCB industry can be segmented based on various factors, including PCB type, application, and end-use industry. The main PCB types include:

- Single-Sided PCBs

- Double-sided PCBs

- Multi-layer PCBs

- Flexible PCBs

- Rigid-Flex PCBs

PCBs find applications across a wide range of industries, such as:

- Consumer Electronics

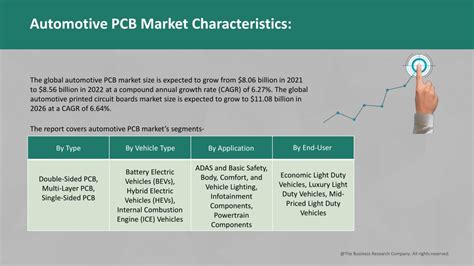

- Automotive

- Telecommunications

- Industrial Electronics

- Medical Devices

- Aerospace and Defense

Market Trends and Drivers

Several key trends and drivers are shaping the China PCB industry, including:

- Miniaturization and high-density interconnect (HDI) PCBs

- Adoption of 5G technology and related infrastructure development

- Growth in the Internet of Things (IoT) and smart devices

- Increasing demand for automotive electronics and electric vehicles (EVs)

- Technological advancements in PCB manufacturing processes

These trends are expected to drive the growth and innovation in the China PCB industry in the coming years.

Industry Challenges and Opportunities

Challenges Faced by the Industry

Despite its strong growth prospects, the China PCB industry faces several challenges that may impact its development:

- Rising labor costs and labor shortages

- Environmental regulations and sustainability concerns

- Intense competition and pricing pressures

- Trade tensions and geopolitical uncertainties

- Technological disruptions and rapid changes in customer preferences

Addressing these challenges will be crucial for the long-term success and sustainability of the China PCB industry.

Opportunities for Growth and Innovation

Notwithstanding the challenges, the China PCB industry presents numerous opportunities for growth and innovation:

- Expansion into high-value-added PCB segments, such as advanced packaging and substrate-like PCBs

- Adoption of Industry 4.0 technologies, including automation, artificial intelligence, and big data analytics

- Development of eco-friendly and sustainable PCB manufacturing processes

- Collaborations and Partnerships with global players for technology transfer and market access

- Upgrading of manufacturing capabilities to meet the demands of emerging applications, such as 5G, IoT, and AI

By capitalizing on these opportunities, the China PCB industry can maintain its competitive edge and drive future growth.

Future Outlook and Investment Landscape

Industry Forecasts and Projections

The China PCB industry is poised for continued growth in the coming years, driven by the increasing demand for electronic devices and the adoption of emerging technologies. Market research firms have provided the following forecasts for the industry:

| Year | Market Size (USD Billion) | Growth Rate (%) |

|---|---|---|

| 2021 | 35.6 | 8.9 |

| 2022 | 38.8 | 9.0 |

| 2023 | 42.3 | 9.0 |

| 2024 | 46.1 | 9.0 |

| 2025 | 50.3 | 9.1 |

These projections indicate a steady growth trajectory for the China PCB industry, with a CAGR of around 9% during the forecast period.

Investment Opportunities and Risks

The China PCB industry presents attractive investment opportunities for both domestic and international investors. Some of the key investment areas include:

- Expansion of production capacity and upgrading of manufacturing facilities

- Development of advanced PCB technologies and materials

- Mergers and acquisitions to consolidate market position and access new markets

- Investment in research and development (R&D) for product innovation and process optimization

However, investors should also be aware of the potential risks associated with the industry, such as:

- Cyclical nature of the electronics industry and demand fluctuations

- Intense competition and pricing pressures

- Regulatory and compliance risks related to environmental and labor standards

- Geopolitical uncertainties and trade tensions

A thorough understanding of the market dynamics, regulatory landscape, and risk factors is essential for making informed investment decisions in the China PCB industry.

Conclusion

The China PCB industry is a vital component of the global electronics manufacturing ecosystem, with a strong growth potential driven by the increasing demand for electronic devices and the adoption of emerging technologies. Despite facing challenges such as rising labor costs, environmental regulations, and intense competition, the industry presents numerous opportunities for growth and innovation.

By capitalizing on these opportunities and addressing the challenges, the China PCB industry can maintain its competitive edge and drive future growth. With the right strategies and investments, the industry is poised to play a crucial role in shaping the future of electronics manufacturing and enabling the development of innovative applications across various sectors.

Frequently Asked Questions (FAQ)

1. What is the current market size of the China PCB industry?

As of 2020, the China PCB industry was valued at approximately USD 32.7 billion.

2. What is the expected growth rate of the China PCB industry during the forecast period?

The China PCB industry is expected to grow at a CAGR of around 9% during the forecast period from 2021 to 2025.

3. What are the main types of PCBs produced in China?

The main types of PCBs produced in China include single-sided PCBs, double-sided PCBs, multi-layer PCBs, flexible PCBs, and rigid-flex PCBs.

4. Which are the key end-use industries for PCBs in China?

The key end-use industries for PCBs in China include consumer electronics, automotive, telecommunications, industrial electronics, medical devices, and aerospace and defense.

5. What are the major challenges faced by the China PCB industry?

The China PCB industry faces challenges such as rising labor costs, environmental regulations, intense competition, trade tensions, and technological disruptions.

No responses yet